Continental, one of the world's largest suppliers of automotive components, is striving to maintain competitiveness in the era of electric vehicles. As a "first step" to improve competitiveness, the group has announced that it will lay off thousands of employees.

On November 13th, the German automotive parts manufacturer announced that it will simplify its business and administrative structure in order to reduce costs by 400 million euros per year and enhance the competitiveness of its automotive industry. The group stated that the exact number of jobs affected globally has not been determined, but it expects the automotive industry to be in the four digit range.

It is reported that Continental will provide a comprehensive strategic update for the industry on Capital Markets Day on December 4, 2023. In order to simplify the structure of the automotive business, the intelligent travel business field will be disbanded. The department will be integrated into five business areas, specifically: architecture and networking, autonomous mobility, security and sports, software and central technology, and user experience.

Our goal is to create a sustainable and profitable industry that can utilize our resources to invest in the future. Through structural adjustments, we will introduce technology solutions into business areas where we see synergies. This will enable us to better respond to market demand, "explained Philipp von Hirschheydt, Executive Board member and Automotive Business Director at Continental.

As part of the transition phase in 2024, some content in the previous intelligent travel business field will be reassigned and managed in other automotive business areas based on natural overlap. The new allocation will focus on three businesses: commercial vehicle electronics and commercial vehicle fleet management services, passenger vehicle actuator solutions (such as door or sunroof control), and automotive aftermarket business.

In addition, according to a recent report by the Financial Times, as early as 2019, Continental warned that 30000 positions would disappear within the next 10 years due to the company's need to invest in expensive electric vehicle transformation - nearly 10000 employees have since left the company. As part of this specific cost reduction plan, an additional 10000 job positions are still under review.

In July 2018, Continental Group decided to carry out organizational restructuring by establishing controlling companies for its three major business departments: Continental Rubber (which includes ContiTech+Tire business), Continental Automotive (which includes ContiTech+Tire business), and Powertrain (which includes Powertrain). This adjustment structure has been implemented since 2020.

In 2021, Continental's powertrain department was split into Vitesco Technologies, which was listed on the Frankfurt Stock Exchange in September of that year.

Starting from January 1, 2022, Continental will be composed of three sub groups: Automotive, Tire, and ContiTech. From the perspective of business and architecture, the changes in Tire and ContiTech subsidiaries are relatively small, while the changes in Automotive subsidiaries are significant. The previous car networking and autonomous driving departments were disbanded and replaced by five business groups: safety and dynamic control, intelligent travel, user experience, architecture and car networking, and autonomous driving and travel business groups.

In August of this year, German media "Manager Magazine" reported that the mainland supervisory board was preparing to spin off and sell the automotive business under the group Contitech. The report states that the pending automotive business may be split, sold, or merged with other companies. The sale will be part of a corporate restructuring plan between Wolfgang Reitzle, the chairman of the group's supervisory board, and Nikolai Setzer, the CEO.

In addition, Greenlight Capital, a shareholder of Weipai Technology, which was spun off from Continental, recently issued an open letter calling on the supplier to pressure Schaeffler to increase the acquisition price or seek other options. On October 9th of this year, Schaeffler proposed to acquire Weipai Technology for 3.64 billion euros. Schaeffler has obtained financing from several banks and is expected to have a one-time integration cost of up to 665 million euros. From the perspective of equity structure, the Schaeffler Group is controlled by the Schaeffler family, which is the largest single shareholder of Weipai Technology.

Schaeffler Group started with automotive bearings, but its scale is not large. However, in 2008, the group took advantage of the global financial crisis to acquire Continental AG, which is three times its size. The Schaeffler family still holds 46% of the shares of Continental AG, making it its largest shareholder.

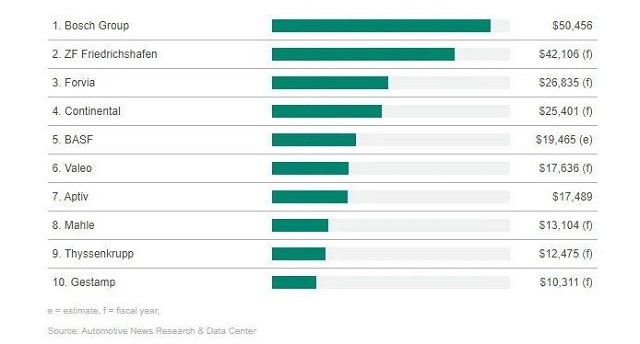

Top 10 global automotive parts suppliers

According to the ranking of the top 100 global automotive component suppliers released by Automotive Nesw in June this year, top automotive component suppliers in North America have demonstrated their traditional inherent power, while representative automotive component suppliers in Asia have demonstrated their competitive advantage in the combination of electric vehicle power batteries and electronic products with traditional products, The product portfolio provided by leading European automotive component suppliers remains an important force in this field.

According to the latest ranking released by the media, Continental ranks 9th on the 2023 Global Top 100 Automotive Parts Suppliers List and 4th among the top ten automotive parts suppliers in Europe, second only to Bosch (Germany), ZF (Germany), and Faurecia (France).

On November 8th, Continental Group released its financial report for the third quarter of 2023, and its overall performance met expectations. Compared to the first half of the year, thanks to sales price adjustments, strict cost control, and stable supply chain, the operating profit of the Continental Automotive subsidiary has significantly improved. In addition, due to a decrease in inventory, the adjusted free cash flow increased year-on-year compared to the first two quarters of 2023. Continental has adjusted its sales forecast for its automotive subsidiary (mainly due to the continued negative impact of exchange rates) and the group's sales forecast. Due to the good earnings of the tire sub group, Continental Group has also slightly raised its adjusted pre interest and tax profit margin forecast for the tire sub group.

Post time: Nov-16-2023