Recently, the domestic steel industry has been turbulent, especially the anti-dumping tax collection policy for carbon steel fasteners has become a focus of attention both inside and outside the industry. With the rise of global trade protectionism, anti-dumping duties, as a trade remedy, are increasingly appearing in our sight.

This policy not only concerns the economic interests of enterprises, but also affects the stability and healthy development of the entire industrial chain. Today, let’s have a detailed understanding of the anti-dumping tax collection policy for carbon steel fasteners.

According to the Anti Dumping Regulations of the People’s Republic of China, the Ministry of Commerce issued a notice on December 29, 2008, deciding to conduct an anti-dumping investigation on imported carbon steel fasteners originating from the European Union.

On June 28, 2010, the Ministry of Commerce issued Announcement No. 40 of 2010, deciding to impose anti-dumping duties on imported carbon steel fasteners originating from the European Union starting from June 29, 2010, with an implementation period of 5 years.

On June 28, 2016, the Ministry of Commerce issued Announcement No. 24 of 2016, deciding to continue imposing anti-dumping duties on imported carbon steel fasteners originating from the European Union from June 29, 2016, for a period of 5 years.

On January 29, 2021, the Ministry of Commerce issued Announcement No. 3 of 2021. According to the announcement, after the end of the Brexit transition period on December 31, 2020, the trade remedy measures previously implemented against the EU will continue to apply to both the EU and the UK, with no change in their implementation period; After this date, the UK will no longer be treated as a member state of the EU for newly initiated trade remedy investigations and review cases.

On June 28, 2022, the Ministry of Commerce issued Announcement No. 17 of 2022, deciding to continue imposing anti-dumping duties on imported carbon steel fasteners originating from the European Union and the United Kingdom starting from June 29, 2022. The anti-dumping duty rate ranges from 55% to 26.0%, and the implementation period is 5 years.

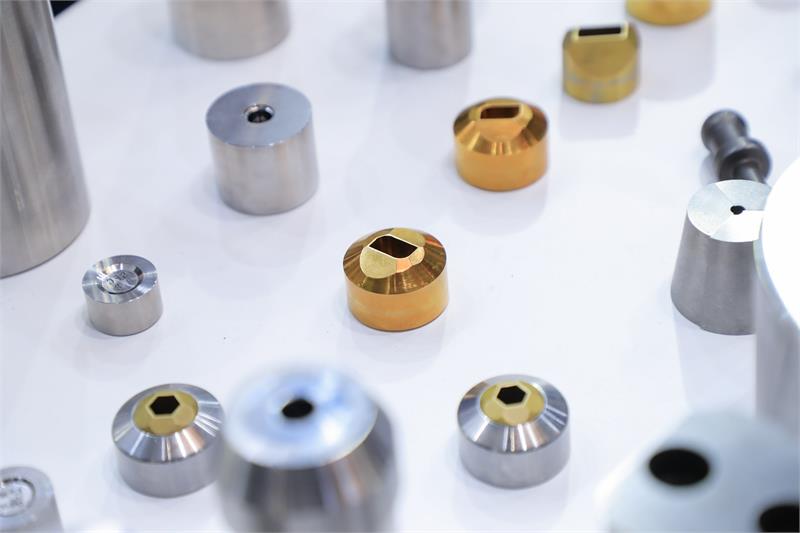

Introduction of surveyed products

Carbon steel fasteners, including wooden screws, self tapping screws, screws and bolts (whether or not with nuts or washers, but excluding screws and bolts used to secure rails and screws and bolts with a rod diameter not exceeding 6 millimeters) and washers. The investigated product scope does not include nuts and fasteners used for maintenance and repair of civil aircraft.

This product is classified as 73181200, 73181400, 73181510, 73181590, 73182100, 73182200, 90211000, and 90212900 in the Import and Export Tariffs of the People’s Republic of China (2023). The fasteners classified under the above tax codes include carbon steel, stainless steel, and alloy steel. It should be noted that stainless steel fasteners are not products under investigation in this case.

Calculation method of anti-dumping duty

Starting from June 29, 2022, import operators shall pay corresponding anti-dumping duties to the customs of the People’s Republic of China when importing carbon steel fasteners originating from the European Union and the United Kingdom. The consignee who declares the import of imported carbon steel fasteners originating from the European Union and the United Kingdom shall truthfully declare their place of origin to the customs and submit relevant proof of origin documents. If the origin is from the European Union and the United Kingdom, an invoice from the original manufacturer is also required. For the above-mentioned goods whose origin cannot be determined, customs shall levy anti-dumping duties in accordance with the highest anti-dumping duty rate listed in Announcement No. 17 of the Ministry of Commerce in 2022. For cases where the origin of the goods can be determined to be the European Union and the United Kingdom, but the import consignee cannot provide an invoice from the original manufacturer, and the original manufacturer cannot be confirmed through other legal and effective means, customs shall impose anti-dumping duties at the corresponding highest anti-dumping tax rate listed in Announcement No. 17 of the Ministry of Commerce in 2022.

The anti-dumping duty is levied based on the customs approved dutiable price, and the calculation formula is: anti-dumping duty=customs dutiable price × The anti-dumping duty rate. The import value-added tax is levied based on the customs approved dutiable value plus tariffs and anti-dumping duties as the taxable price.

How to declare the consignee of imported goods

Correctly fill in the product number

When the consignee of imported goods declares goods that fall within the scope of anti-dumping duties under the above-mentioned tariff codes, the commodity numbers should be filled in as follows: 7318120001, 7318140001, 7318151001, 7318159001, 7318210001, 7318220001, 9021100001, 9021100020, 9021100030, 9021100040, 9021290010, 9021290020, 9021290030, 9021290040.

Key points for standardized declaration of customs declaration forms

According to the Catalogue of Standardized Declaration of Import and Export Commodities by the Customs of the People’s Republic of China, the standardized declaration elements of tariff item 7318 need to fill in the following items: product name (such as square head screw, hook head screw, self tapping screw, bolt, nut, washer, etc.); Material (cannot be simply declared as “steel”, should be specifically declared as “iron”, “non alloy steel”, “stainless steel”, “alloy steel”, etc.): tensile strength (refers to the maximum load-bearing capacity of the metal under static tensile conditions, unit: “MPa megapascals”); Brand (referring to the brand logo added by the manufacturer or distributor to the product, and the Chinese or foreign brand name can be declared according to actual needs); Model (referring to the code set according to factors such as performance, purpose, specifications, and size): Rod diameter (the rod diameter size of the product should be reported for screws and bolts under subheadings 7318.11 to 7318.15, usually in millimeters).

The above information can mostly be obtained from the product label, with common mechanical performance levels of 8.8, 9.8, 10.9, and 12.9. For example, if the mechanical performance level of a bolt is 10.9, it means that the nominal tensile strength of the bolt is 1000MPa, the yield ratio is 0.9, and the yield strength of the bolt is 900MPa.

Post time: Jan-24-2024