Firstly, we need to clarify the classification of fasteners. Whether steel fasteners can be classified under heading 73.18 is a key judgment. If threaded products are not used to secure two or more parts, such as screw plugs (item 83.09) or transmission worms (item 84.83), they cannot be classified under item 73.18. According to the 2022 version of the Harmonized System, implants specifically designed for medical, surgical, dental, or veterinary purposes, such as screws, bolts, etc., should be classified under heading 90.21. Other commonly used steel fasteners are classified under heading 73.18.

The second step is to determine the primary subheading based on the presence or absence of threads. Products with threads are classified under subheading 7318.1, while products without threads are classified under subheading 7318.2. Unthreaded products mainly include washers, rivets, pins, etc.

Step three, determine the corresponding secondary subheadings based on their structure and purpose. Screw products need to distinguish between wooden screws, hook and ring head screws, self tapping screws, or other screws, bolts, nuts, etc. Unthreaded products need to be distinguished as washers, rivets, or pins.

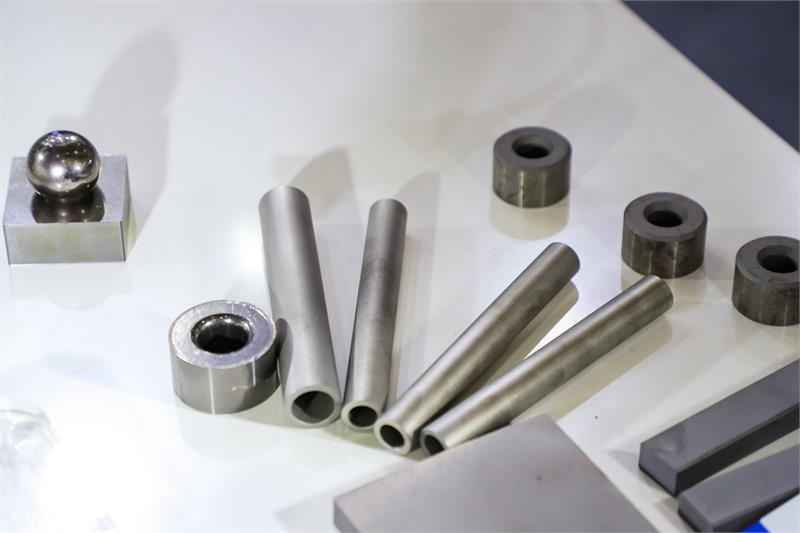

For example, hook head screws and ring head screws (subheading 7318.13) have a curved or circular tail, a conical threaded portion with a pointed head, and are commonly used for hanging or fixing other objects. Self tapping screws (subheading 7318.14) are similar to wooden screws in that they have a slotted head and a cutting thread, with a pointed or tapered end, and are generally used for screwing into thin sheets of plastic, slate, metal, and other materials. Nuts (subheading 7318.16) are used to secure bolts in a certain position, usually threaded throughout, but sometimes one end is a blind hole.

Specification declaration for steel fasteners

For the standardized declaration of fasteners for item 73.18, the 2022 version of the Catalogue of Standardized Declaration for Import and Export Commodities specifies the following elements:

1. Product Name: Clearly indicate the name of the product.

2. Material: It is necessary to declare the specific material of production, such as iron, stainless steel, etc., and cannot simply declare it as “steel”.

3. Types: such as square head screws, self tapping screws, nuts, washers, etc.

4. Tensile strength: refers to the maximum load-bearing capacity of a metal under static tensile conditions, measured in Mpa (megapascals).

5. Brand: The brand logo of the manufacturer or distributor, and the Chinese or foreign brand name should be filled in according to the actual inspection status of the product.

6. Model: A code designed based on factors such as performance, purpose, specifications, or size.

7. Rod diameter: For screws and bolts under subheadings 7318.11 to 7318.15, the rod diameter size of the product should be reported, usually in millimeters.

The above information can usually be obtained from the product label. For example, common mechanical performance grades include 8.8, 9.8, 10.9, and 12.9. The first digit in the marking code represents 1/100 of the nominal tensile strength, and the second digit represents the ratio of the nominal yield point to the nominal tensile strength.

Requirements for Declaration of Origin of Carbon Steel Fasteners

According to the Announcement of the Ministry of Commerce on the Final Review of Anti Dumping Measures for Imported Carbon Steel Fasteners Originating from the European Union and the United Kingdom, anti-dumping duties will continue to be levied on carbon steel fasteners originating from the European Union and the United Kingdom for a period of 5 years starting from June 29, 2022. The declaration requirements for these products include truthful declaration of origin, submission of relevant proof of origin documents, and provision of original manufacturer invoices.

Post time: Mar-11-2024